Bitcoin & Solana Break Up

In my last post on Friday 11th April I was looking at likely rallies coming on both Crypto and equities, and posted some charts looking at the options for that rally on Bitcoin (BTCUSD), Solana (SOLUSD) and Ethereum (ETHUSD).

I posted the contemporaneous chart below back in December and I noted on the chart then that any sharp decline on equity indices historically took Bitcoin down with it, as we have seen, and noted on 11th April that any significant rally on equities would likely take Bitcoin up with it. We’ve been seeing that since.

One thing I would note is that I’ve been talking about the possibility in the premarket webinars that Crypto may start to become a flight to safety destination, & looking at the chart this morning I was saying that did not appear to be becoming the case so far, with Bitcoin still strongly correlated with equities. That may change over coming weeks.

BTCUSD weekly (LOG) vs NDX chart:

There is still an open double top target on Bitcoin in the 69k to 70k area and that is still potentially on the table for later, but the weekly buy signal that was brewing on the chart below on 11th April has since fixed and, if Bitcoin can hold the current levels into the weekly close, should reach at least the possible near miss target then.

The other thing to mention on the chart below is that Bitcoin is trying to break back over a very important level here at the weekly middle band, currently in the 92146 area. If Bitcoin can close the week above that then that is a decent technical break up, albeit a break needing confirmation with another close above that next week.

BTCUSD weekly chart:

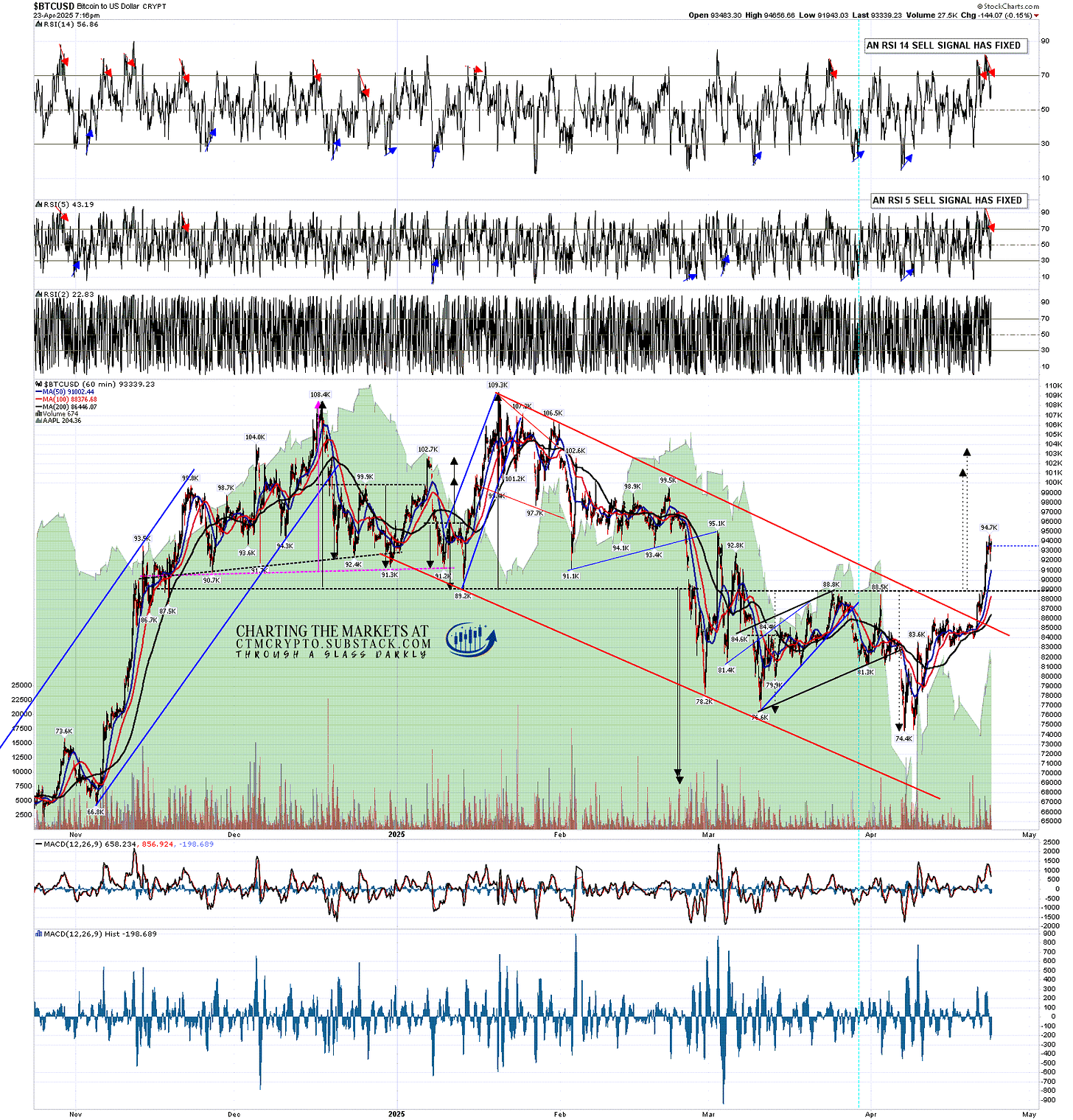

On the Bitcoin hourly chart the decent quality falling wedge that I was looking at on 11th April has since broken up hard, and the possible double bottom that I was looking at has also broken up with alternate targets at 101.5k & 103.8k.

There is a fixed hourly RSI 14 sell signal on the chart below that I was looking at this morning and which is delivering some consolidation so far.

Is this a move to new bull market highs on Bitcoin? Perhaps, but that may only be possible if Bitcoin can become a flight to safety destination, and the evidence for that is thin so far.

BTCUSD 60min chart:

On Solana I sketched out a possible IHS sceario on 11th April and that is still potentially on the table, but so far Solana is breaking up directly over what would alternately be asymmetric double bottom resistance at the late March rally high at 147.53. That break has alternate targets at 183.8 and 198.8. In terms of obvious other targets and possible resistance levels the 200dma is currently at 181 and the 50% retracement of the move down from the all time high is at 195.

SOLUSD 60min chart:

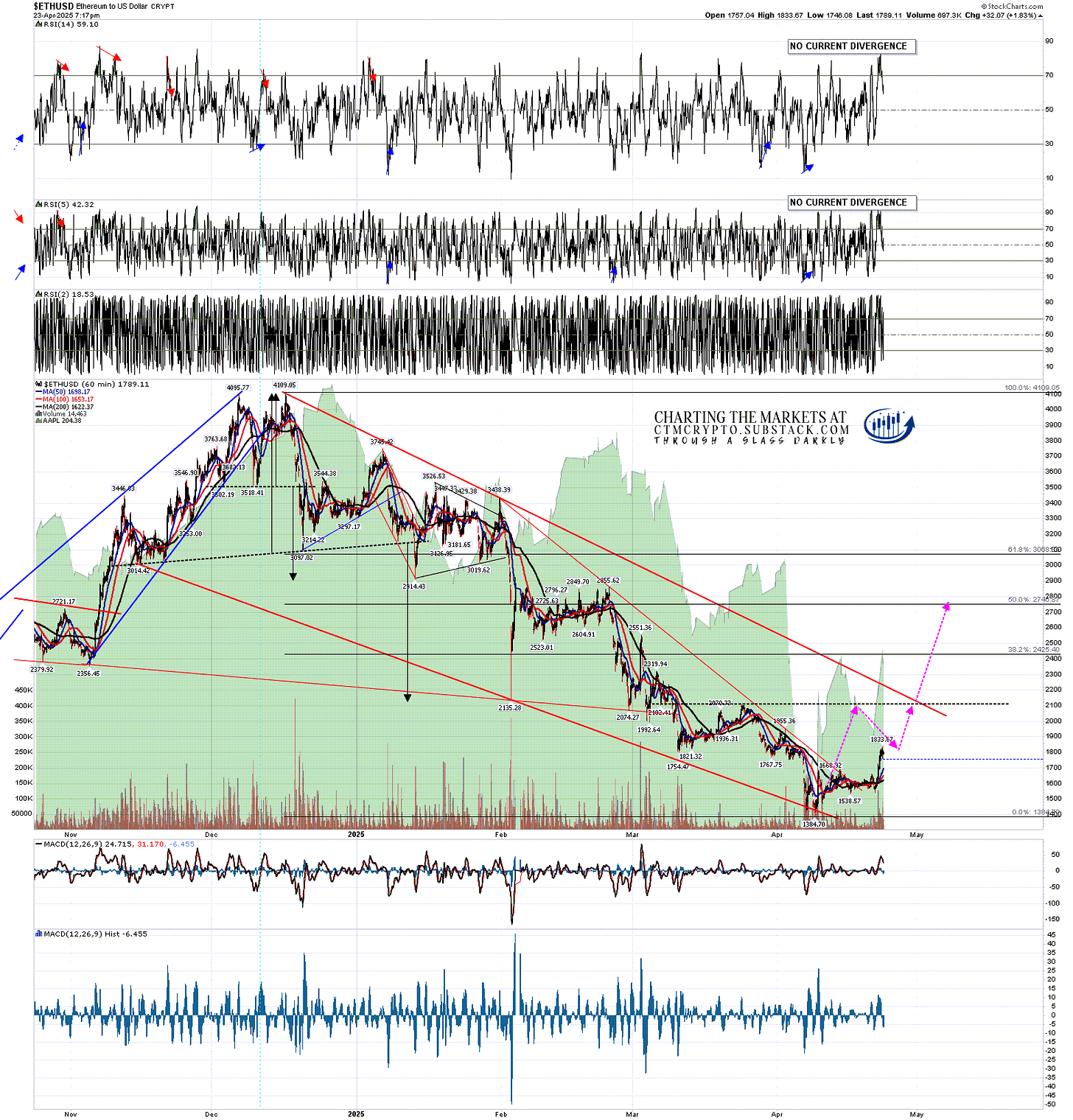

Ethereum is still the poor relation and the rally from 11th April so far is muted, and may stay muted. The IHS scenario I drew on 11th April is still possible, but by the time ETHUSD manages to crawl up there both Bitcoin and Solana would likely have already made their double bottom targets.

The serious relative underperformance on Ethereum so far in this bull market may be telling us that investors are increasingly aware that Ethereum doesn’t do anything that Solana doesn’t do better, faster and cheaper. It’s still a significant player in Crypto, but that may not be the case in the next bull market cycle.

ETHUSD 60min chart:

I’m not seeing much reason here to think that Bitcoin and Solana won’t make at least their lower targets on their double bottoms that have broken up. After that, if we see a hard fail on equities it currently seems likely that would take Crypto down with it.

I am still thinking though that Bitcoin has held up decently against equities in the last few weeks and wondering whether this could be the start of Bitcoin becoming a flight to safety destination as an alternative to US treasuries. If you’re interested I’ll be looking at that more in a post in the next few days on my The Bigger Picture substack.

So far this year I have been and am still leaning towards seeing weakness in the first half of the year and renewed strength in the second half of 2025, with a very possible bull market high on Crypto pencilled in close to the end of the year. That scenario would be a good match with past Crypto bull markets. Is it possible that I am mistaken? Always, but we can only ever try to identify the higher probability paths in the future. Only time can show us the path that is actually taken. Still, I’m with Confucious who said ‘study the past, if you would divine the future’.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.